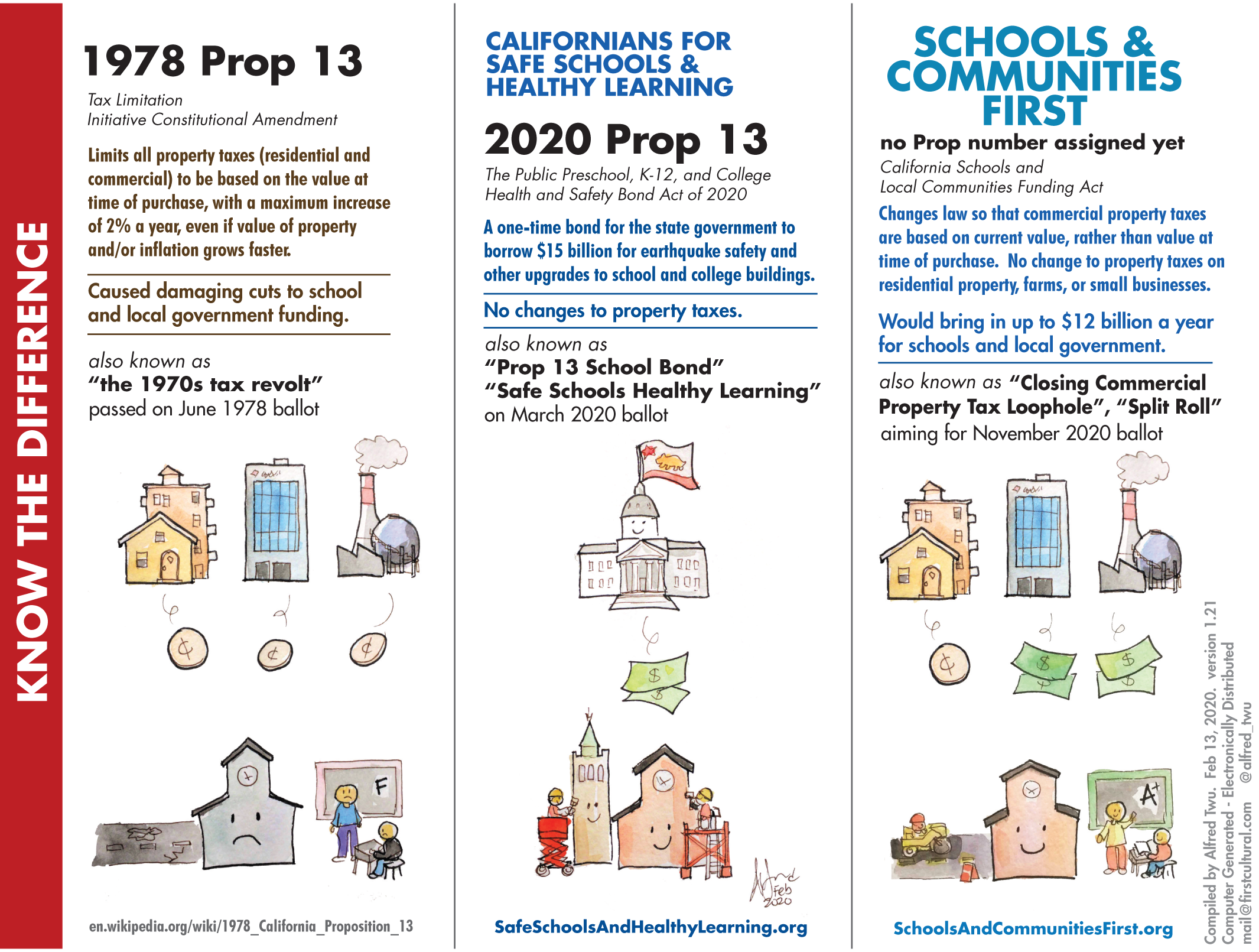

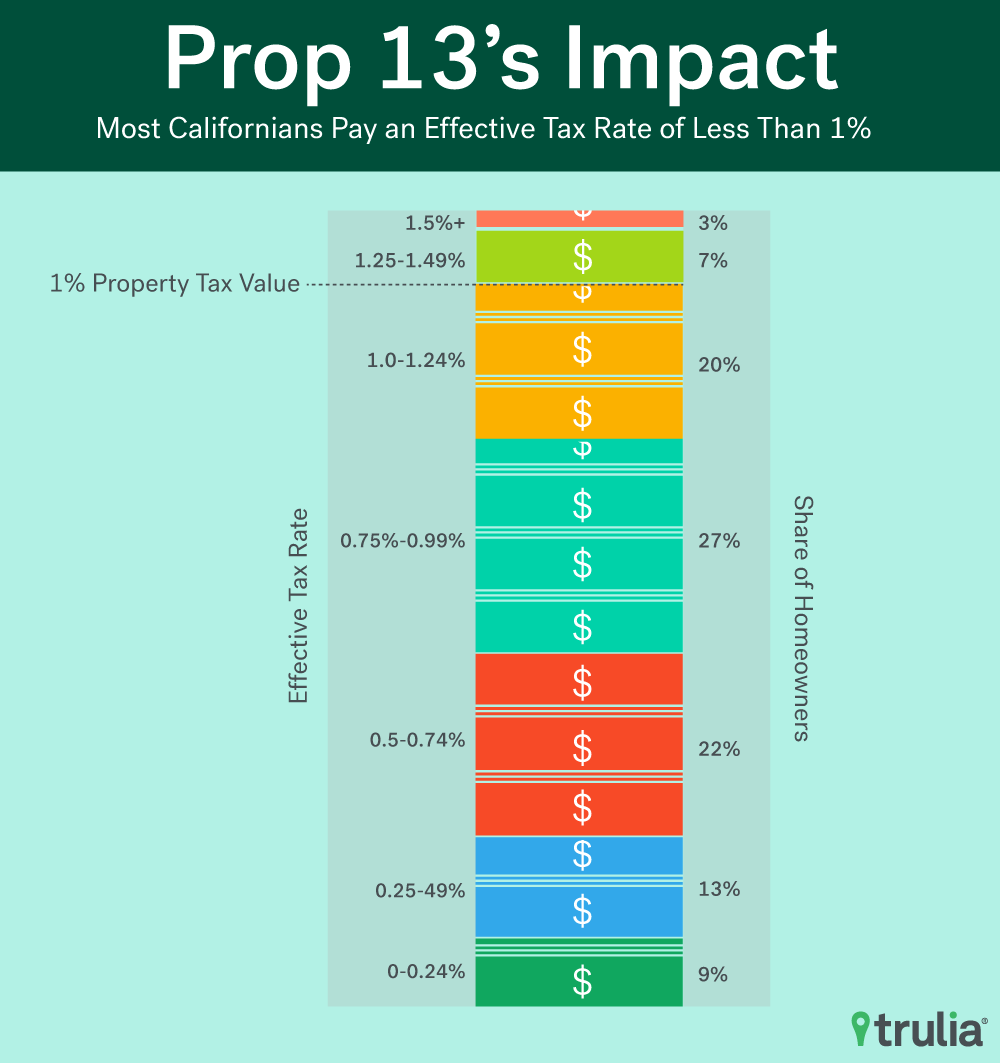

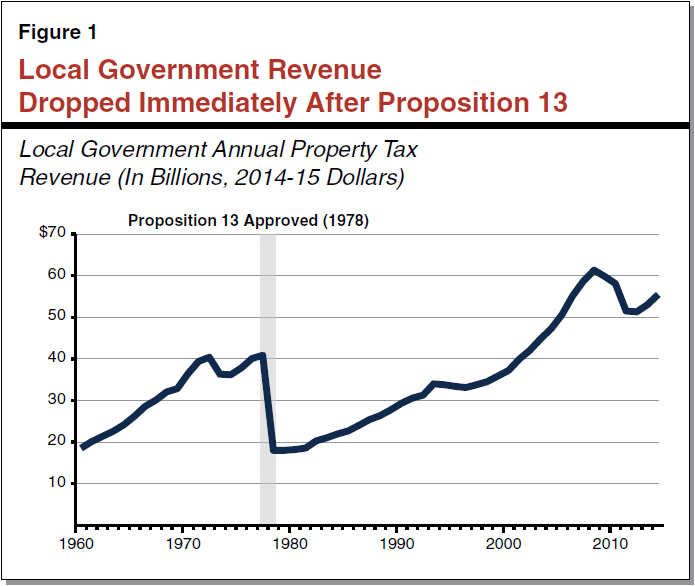

Prop 13 California 2025. It limited tax rates to 1 percent of assessed value and changed how properties are assessed. Proposition 15 targets the latter.

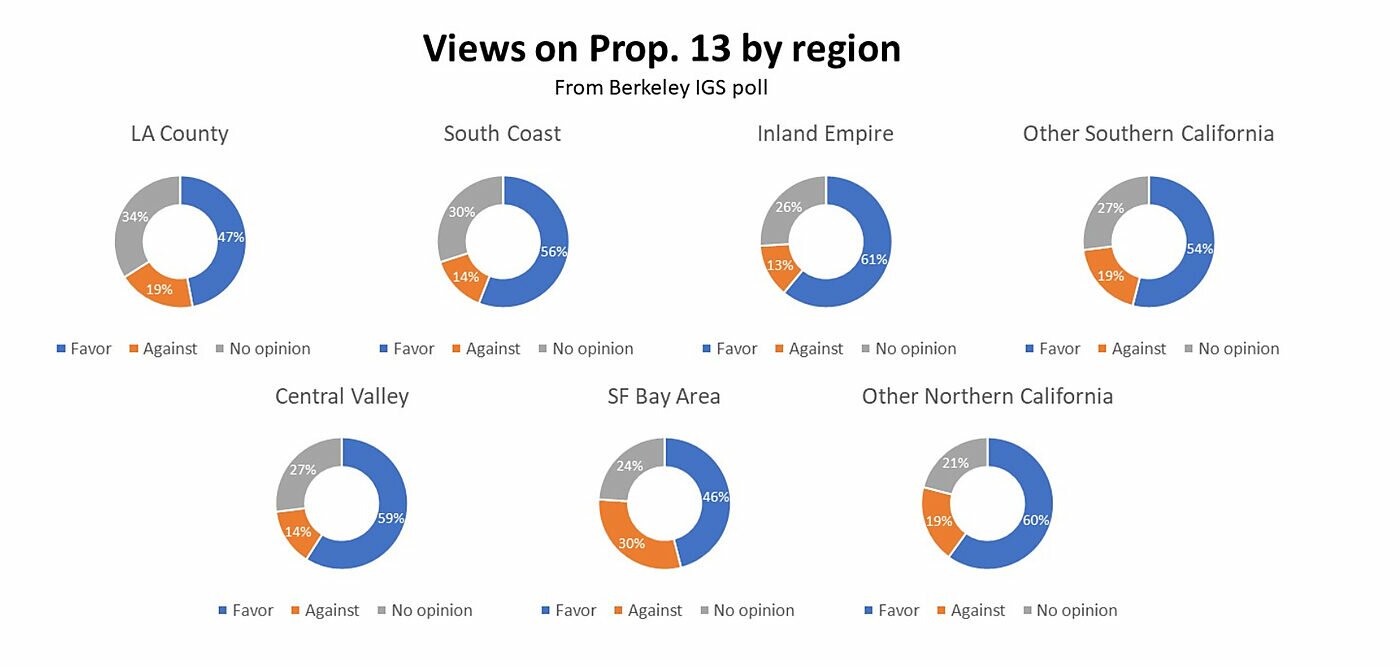

Its most recent major challenge came in 2020 with proposition 15, which aimed to remove commercial properties from prop 13’s jurisdiction. Under current regulations enacted in 1978 as proposition 13, residential, commercial, and industrial properties are taxed based on purchase price.

Capitol As A Relatively Small Number Of.

The story behind the steady growth of the property tax roll in l.a.

A Study By The Legislative Analyst's Office Said The State Would Increase Its Revenues By $6.5 Billion To $11.5 Billion Annually Beginning In 2025.

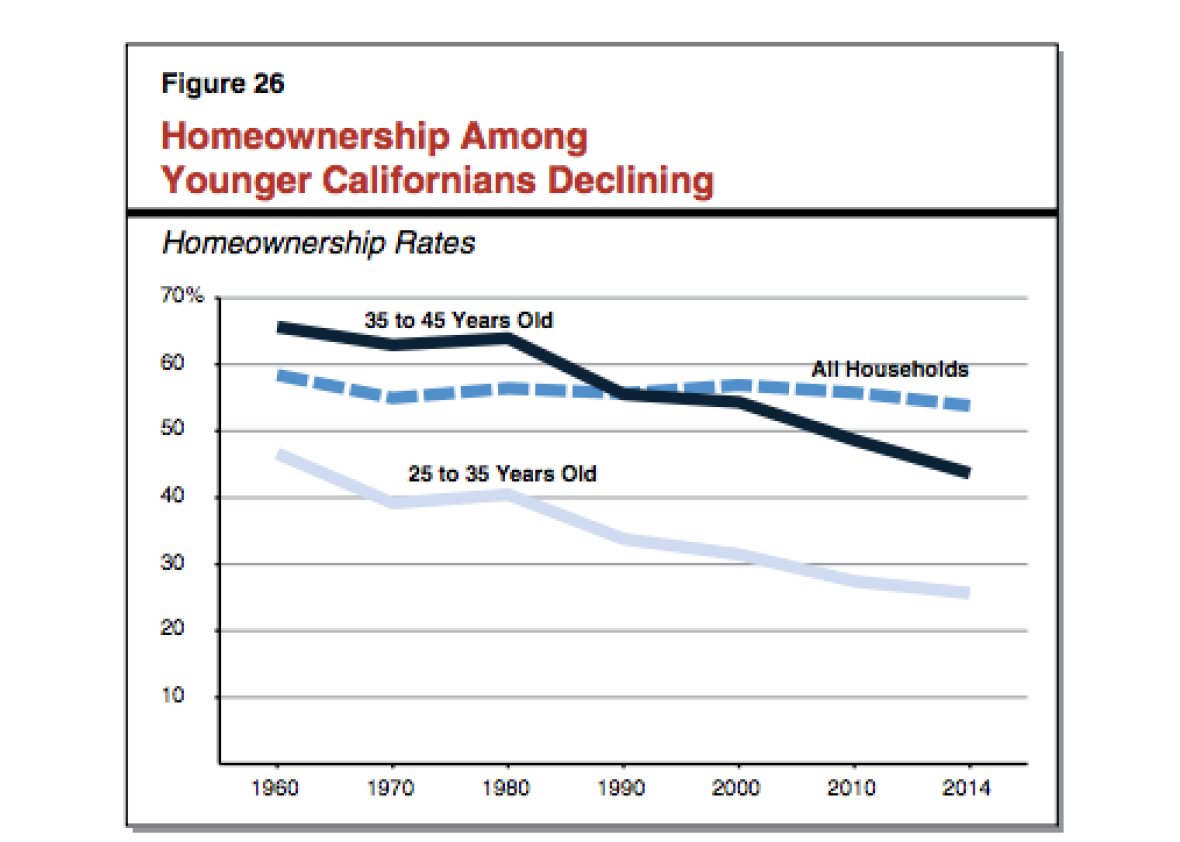

Proposition 13 allows a transfer of primary resident between parent and child without reassessing the tax base of the home.

Prop 13 California 2025 Images References :

Source: ww2.kqed.org

Source: ww2.kqed.org

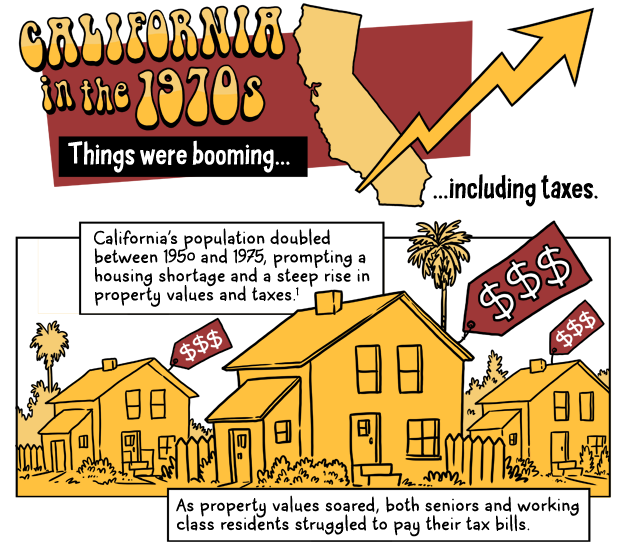

The Taxpayers Revolt! How Prop 13 Transformed California The Lowdown, Under current regulations enacted in 1978 as proposition 13, residential, commercial, and industrial properties are taxed based on purchase price. To this end, she has amassed a powerful coalition including affordable housing advocates, labor councils, local governments, equity organizations and special districts in support of a constitutional amendment to address infrastructure funding challenges introduced by proposition 13 long ago.

Source: la-edex.org

Source: la-edex.org

prop13s Los Angeles Education Examiner, To this end, she has amassed a powerful coalition including affordable housing advocates, labor councils, local governments, equity organizations and special districts in support of a constitutional amendment to address infrastructure funding challenges introduced by proposition 13 long ago. 6 attack on the u.s.

Source: reallyright.com

Source: reallyright.com

California Sliding Into Sea of Economic Insolvency Really Right, 2) be independently owned and operated in california; Trump falsely represented the jan.

Source: www.sbsun.com

Source: www.sbsun.com

Proposition 13 On its 40th anniversary, we look at its history and, For opponents of the measure, including newsom and many in the legislature, it has echoes of prop 13, the landmark 1978 ballot measure that limited property taxes and, in doing so,. The tax is limited to 1% of the purchase price with an annual adjustment equal to the lesser of inflation or 2%.

Source: thenextfind.com

Source: thenextfind.com

24+ Pros and Cons of Proposition 13 (Explained) TheNextFind, Its most recent major challenge came in 2020 with proposition 15, which aimed to remove commercial properties from prop 13’s jurisdiction. After years of slowly attacking and chipping away at prop 13, california democrats are moving in for the kill shot by placing two constitutional amendments on the ballot in 2025 to gut prop 13 and make it easier to raise taxes in california.

Source: www.trulia.com

Source: www.trulia.com

Prop 13 Winners and Losers From America's Legendary Taxpayer Revolt, County, and in california more broadly, is proposition 13. Proposition 15 targets the latter.

Source: www.youtube.com

Source: www.youtube.com

Understanding Proposition 13 California Schools and College Facilities, California voters approved proposition 2 in november 2014, amending the california constitution to revise the rules for the state’s budget stabilization account (bsa), commonly referred to as the rainy day fund. Trump falsely represented the jan.

Source: www.cato.org

Source: www.cato.org

The Future of California Proposition 13 Cato at Liberty Blog, 2025/2025 assessment roll nears $50 billion jun 27, 2025 media contact: Another study by the usc equity research.

Source: lao.ca.gov

Source: lao.ca.gov

Common Claims About Proposition 13, The 1978 citizens’ initiative capped annual increases in the. A study by the legislative analyst's office said the state would increase its revenues by $6.5 billion to $11.5 billion annually beginning in 2025.

Source: slate.com

Source: slate.com

California’s Proposition 13 is bad policy, and here are some graphs to, The term small business must meet all of the following criteria: Proposition 13, a california initiative, offers protections regarding property tax increases.

The Story Behind The Steady Growth Of The Property Tax Roll In L.a.

After years of slowly attacking and chipping away at prop 13, california democrats are moving in for the kill shot by placing two constitutional amendments on the ballot in 2025 to gut prop 13 and make it easier to raise taxes in california.

The Tax Is Limited To 1% Of The Purchase Price With An Annual Adjustment Equal To The Lesser Of Inflation Or 2%.

Proposition 13 allows a transfer of primary resident between parent and child without reassessing the tax base of the home.