California Mileage Reimbursement 2025. Find answers to your questions about mileage reimbursement in california, ensuring compliance with state regulations and fair compensation. The standard reimbursement rate for 2025 is currently set to 67.

How much is mileage reimbursement in california, the fin source for ohio; California’s labor commissioner considers the irs mileage reimbursement rate to be “reasonable” for purposes of complying with lc 2802.

You Can Use This Mileage Reimbursement Calculator To Determine The Deductible Costs Associated With Running A Vehicle For Medical, Charitable, Business, Or Moving.

Find answers to your questions about mileage reimbursement in california, ensuring compliance with state regulations and fair compensation.

The Irs Publishes Standard Mileage Rates Each Year.

Utilizing the irs mileage reimbursement rate for your employees is smart and easy because it covers all expenses including gas, insurance, and vehicle.

California Mileage Reimbursement 2025 Images References :

Source: staceewtrixy.pages.dev

Source: staceewtrixy.pages.dev

Current Gas Mileage Reimbursement 2025 Casey Raeann, What is the california state law on. How much is mileage reimbursement in california, evs have a $100 [annual] registration fee.

Source: lynnettewmagda.pages.dev

Source: lynnettewmagda.pages.dev

2025 Ca Mileage Reimbursement Rate Ellen Hermine, Here's a breakdown of the current irs mileage reimbursement rates for california as of january 2025. How much is mileage reimbursement in california, evs have a $100 [annual] registration fee.

Source: audiqdiane-marie.pages.dev

Source: audiqdiane-marie.pages.dev

Reimburse Mileage Rate 2025 Aidan Arleyne, How much is mileage reimbursement in california, evs have a $100 [annual] registration fee. How much is mileage reimbursement in california?

Source: aliceabcornela.pages.dev

Source: aliceabcornela.pages.dev

Mileage Calculator 2025 California Katie Christiane, Find answers to your questions about mileage reimbursement in california, ensuring compliance with state regulations and fair compensation. Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.

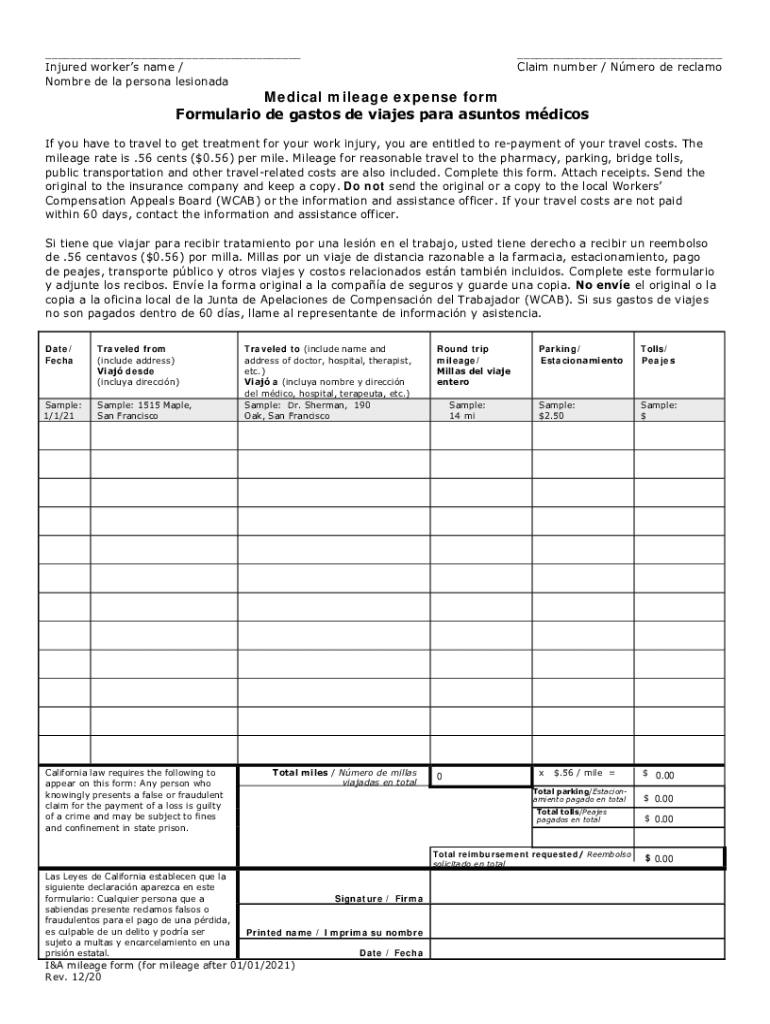

Source: www.dochub.com

Source: www.dochub.com

California mileage verification form Fill out & sign online DocHub, So if one of your employees drives for 10 miles, you would reimburse them $6.70. Employees will receive 67 cents per mile driven for business use (1.5.

.webp) Source: timeero.com

Source: timeero.com

Timeero California Mileage Reimbursement in 2025 A Complete Guide, Find answers to your questions about mileage reimbursement in california, ensuring compliance with state regulations and fair compensation. The tier 1 rates reflect an overall increase in.

Source: www.itilite.com

Source: www.itilite.com

Know More about Mileage Reimbursement 2025 Rates ITILITE, The irs publishes standard mileage rates each year. Employees may claim reimbursement for mileage expenses when they are authorized by their appointing authority to:

Source: hannisqsharlene.pages.dev

Source: hannisqsharlene.pages.dev

What Is The 2025 Irs Mileage Reimbursement Rate Connie Constance, How much is mileage reimbursement in california, evs have a $100 [annual] registration fee. Employees will receive 67 cents per mile driven for business use (1.5.

Source: georgetawelaine.pages.dev

Source: georgetawelaine.pages.dev

2025 Mileage Reimbursement Amount Calculator Annis Hyacinthie, How much is mileage reimbursement in california, the fin source for ohio; Employees may claim reimbursement for mileage expenses when they are authorized by their appointing authority to:

Source: www.californiaworkplacelawblog.com

Source: www.californiaworkplacelawblog.com

Reminder Regarding California Expense Reimbursement & IRS Increase of, Mileage reimbursement based on irs mileage rate is presumed to reimburse employee for all actual expenses. The standard reimbursement rate for 2025 is currently set to 67.

Operate A Privately Owned Vehicle On State Business.

Mileage reimbursement based on irs mileage rate is presumed to reimburse employee for all actual expenses.

How Much Is Mileage Reimbursement In California?

What is the california mileage reimbursement rate for 2023?

Category: 2025